Global semiconductor manufacturing growth momentum will be strong in the third quarter of 2024, and the trend will continue until the end of the year

TechNewsTechnology News

November 27, 2024

Author Atkinson

November 27, 2024

Author Atkinson

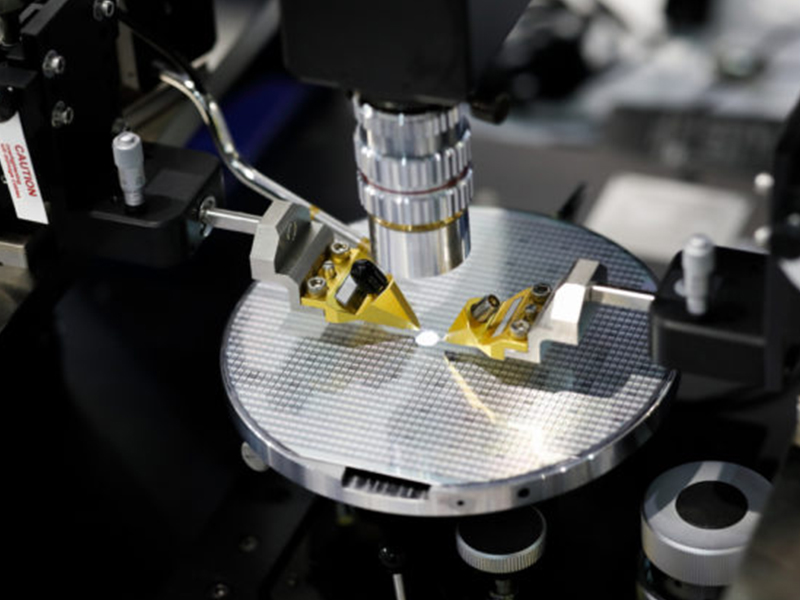

SEMI International Semiconductor Industry Association and TechInsights recently jointly released the Semiconductor Manufacturing Monitoring Report (SSM) for the third quarter of 2024. The growth momentum of the global semiconductor manufacturing industry in this quarter was strong, and all key industry indicators showed a growth trend compared with the previous quarter, which was the first time in two years. . This wave of growth is mainly driven by seasonal factors and strong demand for investment in AI data centers, but the recovery rate of sectors such as consumer, automotive and industrial sectors is still relatively slow. This growth trend is expected to continue into the fourth quarter of 2024.

SEMI pointed out that after declining in the first half of the year, the sales of electronic products finally stopped falling and rebounded in the third quarter of 2024, growing 8% from the previous quarter. It is also expected to grow another 20% in the fourth quarter. IC sales also increased by 12% in the third quarter of 2024 compared with the previous quarter, and are expected to grow by another 10% in the fourth quarter. In 2024, the overall IC sales amount is expected to grow by more than 20%, driven by the overall increase in memory product prices and the strong demand for memory chips in data centers.

In addition, the trend of semiconductor capital expenditures (CapEx) is similar to that of electronic product sales, that is, it will be weak in the first half of 2024 and start to strengthen in the third quarter. Among them, memory-related capital expenditures increased by 34% in the third quarter of 2024 compared with the previous quarter, and by 67% compared with the same period in 2023, reflecting that the memory IC market has greatly improved compared with the same period in 2023. Total capital expenditures in the fourth quarter of 2024 increased by 27% compared with the previous quarter and by 31% compared with the same period in 2023. Among them, memory-related capital expenditures were the largest, increasing by 39% compared with the same period in 2023.

The semiconductor capital equipment market has benefited from China's massive investment, increased spending on high-bandwidth memory (HBM) and advanced packaging, and its performance is still outstanding, better than previous market expectations. Wafer fab equipment (WFE) spending in the third quarter of 2024 increased 15% from the same period in 2023 and 11% from the previous quarter. Chinese investment continues to play an important role in the wafer fab equipment (WFE) market. In addition, the test assembly and packaging fields will achieve growth of 40% and 31% respectively in the third quarter of 2024 compared with the same period in 2023, and the growth trend is expected to continue until the end of the year.

As for the installed capacity of wafer fabs in the third quarter of 2024, it will reach 41.4 million wafers per quarter (based on 12-inch wafer equivalent), and is expected to grow slightly by 1.6% in the fourth quarter of 2024. Wafer foundry and logic-related production capacity also continues to strengthen. Driven by the expansion of advanced and mature node capacity, it will grow by 2% in the third quarter of 2024 and is expected to rise by another 2.2% in the fourth quarter. Memory production capacity increased by 0.6% in the third quarter. Entering the fourth quarter, although strong demand driven by high-bandwidth memory was partially offset by the conversion of process nodes, it will show a stable growth trend.

Zeng Ruiyu, senior director of SEMI Industry Research, analyzed that the semiconductor capital equipment field can maintain strong growth momentum mainly from China's strong investment and increase in advanced technology spending in 2024. In addition, the continued expansion of fab capacity, especially foundry and logic design products, fully demonstrates the industry's commitment to meeting the growing demand for advanced semiconductor technologies.

Boris Metodiev, director of market analysis at TechInsights, pointed out that 2024 will allow us to see two different aspects of the semiconductor industry. While the consumer, automotive and industrial markets are struggling, the AI field is booming, driving up the average selling price of memory and logic products. Looking ahead to 2025, consumer confidence is expected to improve as interest rates fall, spurring higher purchases to support consumers and the auto market.

Related links: https://technews.tw/2024/11/27/global-semiconductor-manufacturing-showed-strong-growth-momentum-in-the-third-quarter-of-2024/

Image source: shutterstock

【Disclaimer】

The content of this article represents only the author’s personal views and has nothing to do with Creating.

The content, textual description and originality have not been confirmed by this site. This site does not make any guarantee or commitment for this article and all or part of its content, authenticity, completeness, and timeliness. It is for readers' reference only. Please verify the relevant content by yourself.

Creating Nano Technologies, Inc.

59 Alley 21 Lane 279, Chung Cheng Road, Yung Kang City, Tainan, TAIWAN

TEL:886-6-2323927 FAX:886-6-2013306 URL: http://www.creating-nanotech.com